Trump tariffs can hurt global trade by as much as 6%, annually.

Background

Readers would recall that Trump had promised to his supporters that he would bring back jobs to the Americans. Over the years, several American steel and other manufacturing plants had shut down because of ‘cheap international imports’.

After Trump came to power, he announced several steps to bring back to the American their jobs. First, he withdrew from the Trans -Pacific Trade Partnership which was signed by his predecessor, Barrack Obama.

Next, Trump decided to launch an investigation into cases of theft of American intellectual property by ‘Chinese firms’.

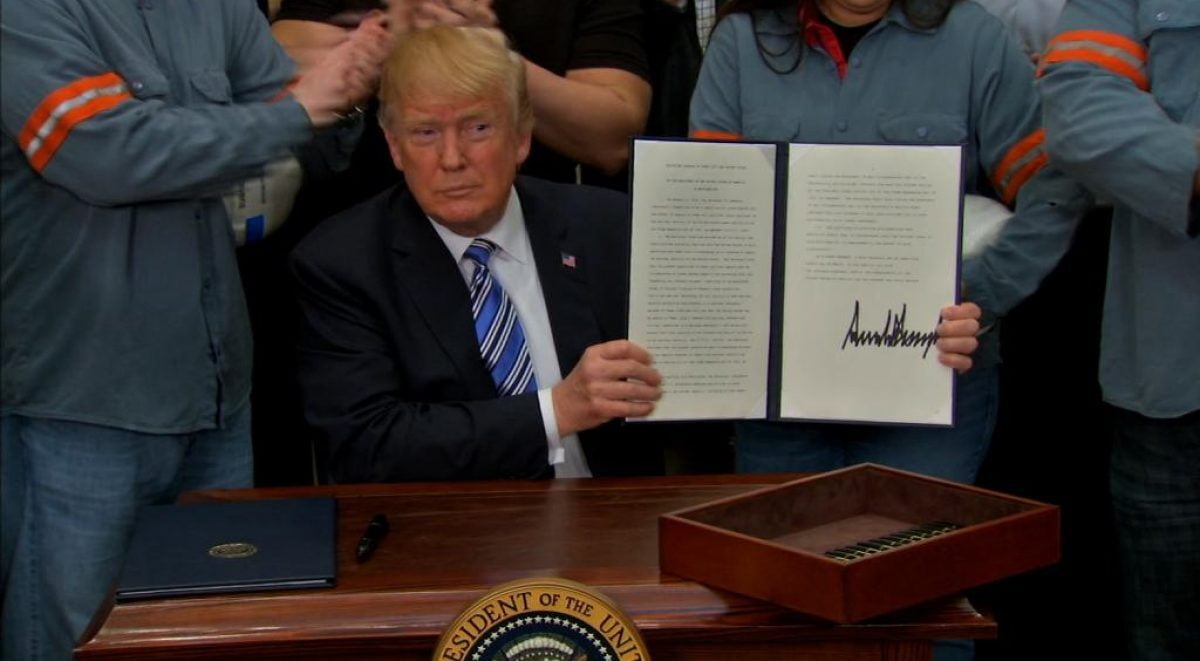

That was not all, a few weeks back, the American President imposed new tariffs on steel and aluminum imports. In addition, he also promised to come hard on other China-made products to reduce the trade surplus with that country.

The new trade duties on aluminium and steel were 25% and 10 % respectively.

Within a matter of days after the announcement of new tariffs, China also announced its own measures to restrict American imports. In short, a full-blown trade war is looming large on the horizons of the global economy.

Impact on EU-US trade by Trump tariffs

A Reuters report dated March 9, 2018 says that European steelmakers are hoping for a breakthrough in trade talks between EU and the US. Essentially, these steel companies want an exemption from the US on revised steel duties and tariffs.

As soon as the new duties were announced by the Trump administration, the European steel markets dipped a bit. Key steelmakers like Arcelor Mittal and Tata Steel saw their share prices slide down by as much as 0.6%.

However, many steelmakers also said that revised steel tariffs will have a negligible impact on their financials.

EU is the biggest exporter of steel to the United States. It accounts for 5 million tonnes out of the total 35 million tonnes of steel imported by the US.

The Dutch bank, ING, estimates that the contribution of EU steel and aluminum exports to US is just 0.3 % of the bloc’s global trade. However, should the trade war flare up between the EU and the US, then its impact could knock 0.4% from US growth and 0.3% from the EU. This is a significant statistic as it will adversely affect several US and Europe- based businesses.

Already, the EU has declared that it will raise import duties on a range of high profile American goods. It has also promised to start a case against the US at the World Trade Organization.

Impact on Canada

For Canada, the new tariff structure is indeed worrisome. More than 90 percent of Canadian steel goes to the United States according to the Canadian Steel Producers Association.

Post the imposition of new duties, Canadians will have to pay more for their cars, refrigerators, and beer. The Canadian economy will lose around USD 3 billion a year because of new steel duties. This hit would be the biggest for any country. In contrast, China will lose just USD 650 million annually because of increased American tariff on steel and aluminum.

Canadian steel and aluminum industries employ around 30,000 people and analysts warn that there would be significant job losses in these industries.

But interestingly, post the new tariff regime, Canadian GDP will slow down by just 0.2-0.3 %.

On China

Morgan Stanley estimates that the Trump tariffs will reduce total Chinese exports by just 0.8 %. The Chinese GDP will be hit by just 0.1 %, the same report says.

Trump has identified a list of 1,300 plus items that can attract revised tariffs.

Various experts also say that the Made in China initiative will be severely impacted by these protectionist measures.

US companies based in China will also be hit by these measures. For example, General Motors will find its Chinese operations unviable in the medium to long-term.